After the new VAT policy was clear in March, many companies’ financial departments have issued the “Notice on the Work of Adjusting the VAT Rate Adjustment” to clarify the invoice tax rate standard after April 1!

Employee travel accommodation

Open a VAT ticket? Or is it a VAT vote?

1. If you are on a business trip, should you issue a VAT ticket or a VAT ticket?

A: When requesting an invoice, it is necessary to distinguish between different situations. If a small-scale taxpayer’s enterprise employee is on a business trip, he or she may choose to open a VAT ordinary invoice; if the VAT general taxpayer’s enterprise employee is on a business trip, he should The hotel requests a special VAT invoice.

Second, on business trips, should I issue a special VAT invoice or a VAT ordinary invoice? If you get a special VAT invoice, can you deduct it?

A: VAT invoices are divided into VAT special invoices and VAT ordinary invoices. The fundamental difference between the two is that the former can deduct the input tax amount, and the latter cannot. According to the provisions of Caishui [2016] No. 36, the input tax on the purchase of catering services cannot be deducted from the output tax. Therefore, the meals and entertainment expenses for social entertainment are all not deductible, even if the VAT special invoice does not work.

Therefore, if you are on a business trip, you should issue a VAT ordinary invoice. However, the inability to deduct does not mean that the special ticket cannot be opened. If a special ticket for the non-deductible item is obtained, it is recommended to first re-export the re-input tax.

Third, dining at the hotel, accommodation and food and beverage fees can be opened on the same invoice?

A: A small-scale taxpayer can open the project on an invoice; for a general taxpayer, the VAT special invoice for the travel expenses incurred on the business trip can be deducted from the input tax, and the catering, entertainment, etc. cannot be deducted, so Invoices will be invoiced for accommodation, catering, entertainment, etc., and special invoices for value-added tax will be issued for accommodation, and ordinary VAT invoices will be issued for catering and entertainment. If general taxpayers open accommodation, catering and entertainment on a special ticket, they should be certified. The tax amount for the catering and entertainment parts will be transferred out as input tax.

Fourth, friendship reminder

Whether it is a special VAT invoice or a VAT ordinary invoice, when invoicing, it must be filled in according to the number order, complete the project, the content is true, the writing is clear, all printed once, the content is completely consistent, and the invoice Union and deductible joint stamping invoice special seal.

Remember to check the above information when you get the invoice!

Document basis:

Notice of the Ministry of Finance and the State Administration of Taxation on Launching the Pilot Program for the Change of Business Tax to VAT (Finance Tax [2016] No. 36)

Article 27 The input tax amount of the following items shall not be deducted from the output tax amount: (6) purchased passenger transportation services, loan services, catering services, daily services for residents and entertainment services.

The same is the ticket and ticket

Some can be deducted, and some can not be deducted!

First, the same ticket:

Obtaining the information indicating the passenger's identity can be deducted, and obtaining the unidentified passenger identity information can not be deducted.

Second, the same ticket:

The purchase of domestic passenger transportation services can be deducted, and the purchase of international passenger transportation services cannot be deducted.

Third, the same ticket:

The VAT electronic ordinary invoices that have been issued with the indicated tax amount can be deducted according to the tax amount, and the electronic ordinary invoices for recharging “no taxation” VAT (no tax on the invoice) can not be deducted.

Fourth, the same is the plane ticket:

Only fares + fuel surcharges can be deducted, and items other than fares + fuel surcharges (such as airport construction fees) cannot be deducted.

Fifth, the same ticket:

The date of acquisition is deductible after April 1st, and the date of acquisition is not deductible until April 1st.

Sixth, the same ticket:

Only the general taxpayer can deduct, small-scale taxpayers can not deduct.

Seven, the same ticket:

It can be deducted related to the operation, but it can not be deducted for the simple tax calculation method, the VAT exemption, the collective welfare or the personal consumption.

Eight, the same ticket:

The employees of the company can be deducted for business trips, and the reimbursement for foreigners is not deductible.

Tax authority monitoring

Tax General Letter [2019] No. 81 of the State Administration of Taxation, "Notice on Doing a Good Job in the First Stage of Deepening the VAT Reform in 2019, "Opening a Good Ticket":

Eight, tracking and monitoring the invoice issue

It should be noted that local tax authorities should conduct dynamic monitoring and analysis of taxpayer invoices. Before April 1st, it is important to monitor the taxpayer's misuse of the new tax rate for invoicing. For example, if the taxpayer misunderstood the policy, he or she would in error issue an invoice with a 13% tax rate, and the local tax authorities should correct it in time.

After April 1st, it is important to monitor the taxpayer's misuse of the old tax rate for invoicing. For a large number of invoices with the original applicable tax rate or a large number of red punches, invalidation of the original applicable tax rate invoices, etc., timely analysis and judgment, and carry out targeted services and management. If it is suspected of virtual invoicing and meets the characteristics of risk taxpayers, it shall rely on the rapid response mechanism of VAT invoice risk to conduct timely verification and processing.

Attached: VAT deduction and taxation 8 reminders

Reminder One:

The taxpayer can calculate the deductible value-added tax only after purchasing the domestic passenger transportation service.

Reminder 2:

The VAT can be deducted after the date of the ticket is obtained from April 1st.

Reminder three:

Deductions are not counted for travel tickets that are specifically for welfare, hospitality, or tax-free project activities.

Reminder four:

If the ticket obtains the VAT electronic ordinary invoice, the tax amount stated on the invoice will be used to deduct the VAT.

Reminder 5:

Deductions shall not be calculated for rental tickets, bus tickets, etc. that do not indicate passenger identity information.

Reminder 6:

The entry tax amount of the air transport e-ticket itinerary with the passenger identification information is calculated according to 9%. The information that can be deducted from the air transport e-ticket itinerary is the fare + fuel surcharge.

Reminder Seven:

The ticket deduction is not based on the full amount of the ticket, but is first converted to the tax-free amount and multiplied by the applicable VAT rate.

Reminder 8:

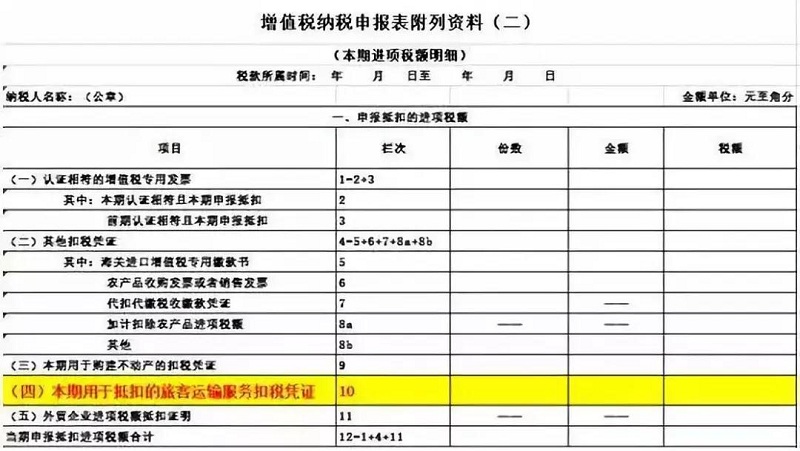

The VAT for the calculation of the deduction of the ticket shall be filled in the 10th line of the attached data of the VAT return (2):

Source: State Administration of Taxation, Mr. Hao said that accounting, Shanghai Second Inspection Bureau, Xiao Chen tax, tax to tax

Who is Shang Hao?

We are experts in the manufacture of industrial refrigeration and civil air conditioners.

Is engaged in research and development, design, production, sales and installation of refrigeration equipment.

High-tech enterprise

Our refrigeration equipment control system is commonly used by companies around the world.

Our refrigeration equipment applications are

Chemical, chemical fiber, plastics, grease, food,

Pharmaceutical, military, printing, painting, electroplating, electronics, etc...

Industrial refrigeration, chiller, Water-cooled screw chiller, industrial chiller, screw chiller, air-cooled chiller, buy products on the Shanghai Shangyu Refrigeration Equipment Co., Ltd., the company is a refrigeration equipment research and development, design, production, sales And high-tech enterprises, such as installation.

At present, Shanghai SUNNY-HVAC's Water-cooled screw chiller, industrial refrigeration, chillers, chillers, Water-cooled screw chiller, screw chillers, and air-cooled chillers have been widely used in chemical, chemical fiber, plastic, grease, food, Pharmaceuticals, military industry, printing, coating, electroplating, electronics and other industries provide high-speed development of China's industry with efficiency and quality assurance.